Looking for the best car insurance plans for new cars? Learn coverage options, add-ons, real insurance costs by car model, and smart buying tips.

Buying a new car is one of those moments that feels special. The smell of a fresh interior, the shine of untouched paint, and that proud feeling when you turn the key for the first time—it’s exciting. But right after that excitement comes an important decision many people rush through: choosing the right car insurance.

For new car owners, insurance isn’t just a legal formality. It’s protection for something you’ve invested your hard-earned money in. Choosing the best car insurance plans for new cars can save you thousands of rupees, reduce stress during accidents, and give you peace of mind every time you hit the road.

Let’s break everything down in simple, honest language—no confusing jargon, no robotic explanations.

Best Car Insurance Plans for New Cars You Shouldn’t Miss

Buying a new car is exciting. For many people in India, it’s not just a vehicle—it’s a dream, a milestone, and sometimes the biggest purchase after a house. But right after the delivery celebration, there’s one decision that actually protects that dream: car insurance.

Most buyers either rush this step or blindly accept whatever the dealer suggests. That’s where people go wrong.

If you really want the best car insurance plans for new cars, you need clarity—about coverage, real costs, add-ons, and how much insurance actually costs for different cars in India.

According to leading insurers in India, companies like ICICI Lombard, Bajaj Allianz, HDFC ERGO and others offer some of the best car insurance plans for new cars, combining wide coverage, add-ons and strong claim support.

Let’s break everything down honestly, simply, and practically—no confusing language, no copy-paste content.

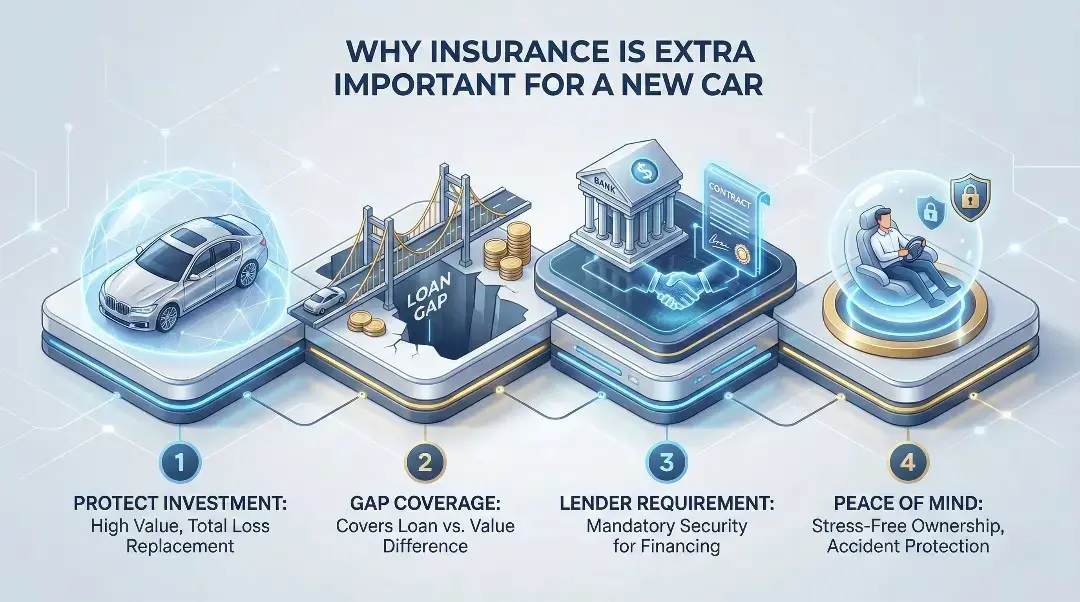

Why Insurance Is Extra Important for a New Car

best car insurance plans for new cars A new car is most expensive on day one. Even a small accident can burn a hole in your pocket.

Here’s why new cars need strong insurance:

- Spare parts are costly

- Paint and body repairs aren’t cheap

- New cars have sensors, cameras, electronics

- Even minor damage can cost ₹10,000–₹50,000

That’s why choosing the best car insurance plans for new cars is not optional—it’s essential.

Types of Car Insurance Plans in India

best car insurance plans for new cars Before choosing the “best”, you must understand the basics.

1. Third-Party Insurance (Mandatory but Limited)

Covers:

- Damage to another vehicle

- Injury or death of a third person

Does NOT cover:

- Your own car damage

- Theft

- Natural disasters

Good only for legal compliance, not recommended for new cars.

2. Comprehensive Car Insurance (Best for New Cars)

Covers:

- Third-party damage

- Own car damage

- Theft

- Fire, flood, cyclone, earthquake

- Accidents

Almost all best car insurance plans for new cars are comprehensive policies.

3. Standalone Own Damage Policy

best car insurance plans for new cars If you already have third-party insurance, this covers only your car.

Add-Ons That Make Insurance Truly “Best”

For a new car, add-ons are not extras—they’re protection upgrades.

Zero Depreciation Cover (Highly Recommended)

Without this, insurance deducts depreciation on parts during claims.

With zero dep:

- No deduction on plastic, metal parts

- Higher claim amount

- Peace of mind

Best for first 3–5 years.

Engine Protection Cover

Covers engine damage due to:

- Floods

- Waterlogging

- Oil leakage

Perfect for Indian monsoons.

Return to Invoice (RTI)

If your car is stolen or completely damaged:

- You get ex-showroom price

- Registration + road tax refunded

Very powerful add-on for new cars.

Roadside Assistance

Covers:

- Breakdown

- Flat tyre

- Emergency towing

Small cost, big relief.

Real Question: New Car Insurance Cost in India

Now let’s come to what you really asked

Below are approximate first-year comprehensive insurance costs (with zero dep) in India. Prices vary by city, insurer, and add-ons, but these are realistic ranges.

Hatchback Insurance Cost (New Car)

| Car Model | Ex-Showroom Price | Insurance Cost (₹/Year) |

|---|---|---|

| Maruti Alto K10 | ₹4–5 lakh | ₹18,000 – ₹22,000 |

| Maruti WagonR | ₹5.5–6.5 lakh | ₹20,000 – ₹25,000 |

| Tata Tiago | ₹6–7.5 lakh | ₹22,000 – ₹28,000 |

| Hyundai i10 Nios | ₹6–8 lakh | ₹23,000 – ₹30,000 |

Hatchbacks have lower premiums but still need comprehensive insurance.

Compact SUV Insurance Cost

| Car Model | Ex-Showroom Price | Insurance Cost (₹/Year) |

|---|---|---|

| Tata Punch | ₹6–9 lakh | ₹25,000 – ₹32,000 |

| Hyundai Exter | ₹6–10 lakh | ₹26,000 – ₹34,000 |

| Maruti Brezza | ₹8–13 lakh | ₹30,000 – ₹40,000 |

| Tata Nexon | ₹8–15 lakh | ₹32,000 – ₹45,000 |

Compact SUVs are among the most searched under best car insurance plans for new cars category.

Sedan Insurance Cost

| Car Model | Ex-Showroom Price | Insurance Cost (₹/Year) |

|---|---|---|

| Maruti Dzire | ₹6.5–9.5 lakh | ₹25,000 – ₹35,000 |

| Hyundai Aura | ₹6–9 lakh | ₹24,000 – ₹34,000 |

| Honda City | ₹11–16 lakh | ₹38,000 – ₹55,000 |

| Skoda Slavia | ₹11–18 lakh | ₹40,000 – ₹60,000 |

Mid-Size & Premium SUV Insurance Cost

| Car Model | Ex-Showroom Price | Insurance Cost (₹/Year) |

|---|---|---|

| Hyundai Creta | ₹11–20 lakh | ₹45,000 – ₹70,000 |

| Kia Seltos | ₹11–20 lakh | ₹46,000 – ₹72,000 |

| Mahindra XUV700 | ₹14–26 lakh | ₹55,000 – ₹90,000 |

| Toyota Fortuner | ₹33–50 lakh | ₹1.1 – 1.6 lakh |

Premium SUVs require strong coverage—cheap insurance here is risky.

Electric Car Insurance Cost

| EV Model | Ex-Showroom Price | Insurance Cost (₹/Year) |

|---|---|---|

| Tata Tiago EV | ₹8–12 lakh | ₹28,000 – ₹40,000 |

| Tata Nexon EV | ₹14–19 lakh | ₹45,000 – ₹70,000 |

| MG ZS EV | ₹18–25 lakh | ₹60,000 – ₹90,000 |

EV insurance is slightly higher due to battery replacement cost.

Dealer Insurance vs Online Insurance (Truth)

Dealer Insurance

- Convenient

- More expensive

- Limited choice

Online Insurance

- Cheaper

- Multiple insurers

- Better add-on control

Most smart buyers find the best car insurance plans for new cars online, not at the dealership.

How to Choose the Best Car Insurance Plan for Your New Car

Follow this simple human checklist:

- Always choose comprehensive insurance

- Add zero depreciation

- Check claim settlement ratio

- Compare at least 3 insurers

- Don’t over-add useless covers

Simple decisions save big money later.

Common Mistakes New Car Owners Make

- Choosing cheapest policy only

- Skipping zero dep

- Not checking claim history

- Trusting dealer blindly

- Ignoring add-on details

Avoid these and you’re already smarter than 70% buyers.

Final Thoughts

Your new car deserves proper protection, not guesswork. The right insurance plan saves money, time, and mental stress when things go wrong.

By understanding coverage, real insurance costs, and smart add-ons, you can confidently choose one of the best car insurance plans for new cars without regret.

Insurance is not an expense—it’s security.

FAQs

Which insurance is best for a new car?

Comprehensive insurance with zero depreciation.

Is zero dep really worth it?

Yes, especially in the first 3–5 years.

Can I change insurance later?

Yes, during renewal.

Is third-party insurance enough?

Legally yes, financially no.

Does city affect insurance price?

Yes, metro cities usually have higher premiums.